The Executive's M&A Checklist for AI Due Diligence in 2025

As we enter 2025, the integration of artificial intelligence (AI) into mergers and acquisitions (M&A) has become a pivotal factor for executives seeking to drive innovation and competitive advantage. With AI technologies reshaping industries from healthcare to finance, the stakes in acquiring or partnering with AI-driven companies are higher than ever. However, the complexity of AI - spanning technical intricacies, ethical considerations, and unique valuation challenges - demands a tailored due diligence process. This comprehensive guide, drawing from recent industry analyses and frameworks, translates technical assessment criteria into actionable insights for business leaders. It outlines a detailed checklist, explores valuation frameworks, and highlights critical risks and opportunities in AI M&A.

The Evolving Landscape of AI M&A

The AI mergers and acquisitions market in 2025 is overall marked by escalating acquisition activity, with valuations representing investor enthusiasm about transformative technologies. The 90+ acquisitions analysed saw a revenue multiple of 25.8x enterprise value (EV), illustrating the premium associated with growth potential.

This represents a significant shift from conventional software acquisitions, given that AI’s variable costs and rapid innovation cycles can bring new rules into play. Executives will need to go beyond typical financial assessments to assess AI-related aspects, such as the integrity of the data, and model scalability of the model to prevent overpayment or inheriting technologies that are easily rendered unusable.

For the business leader who has no deep technical background, that means a focus on the few high-level questions:

Is the AI technology generating measurable business value?

Is AI compliant and ethical?

How does it scale within the company?

Once they clarify these issues, executives can support AI acquisitions in alignment with business strategy, potentially enhancing efficiencies and generating new revenues, while at the same time protecting against risk for compliance and technology obsolescence.

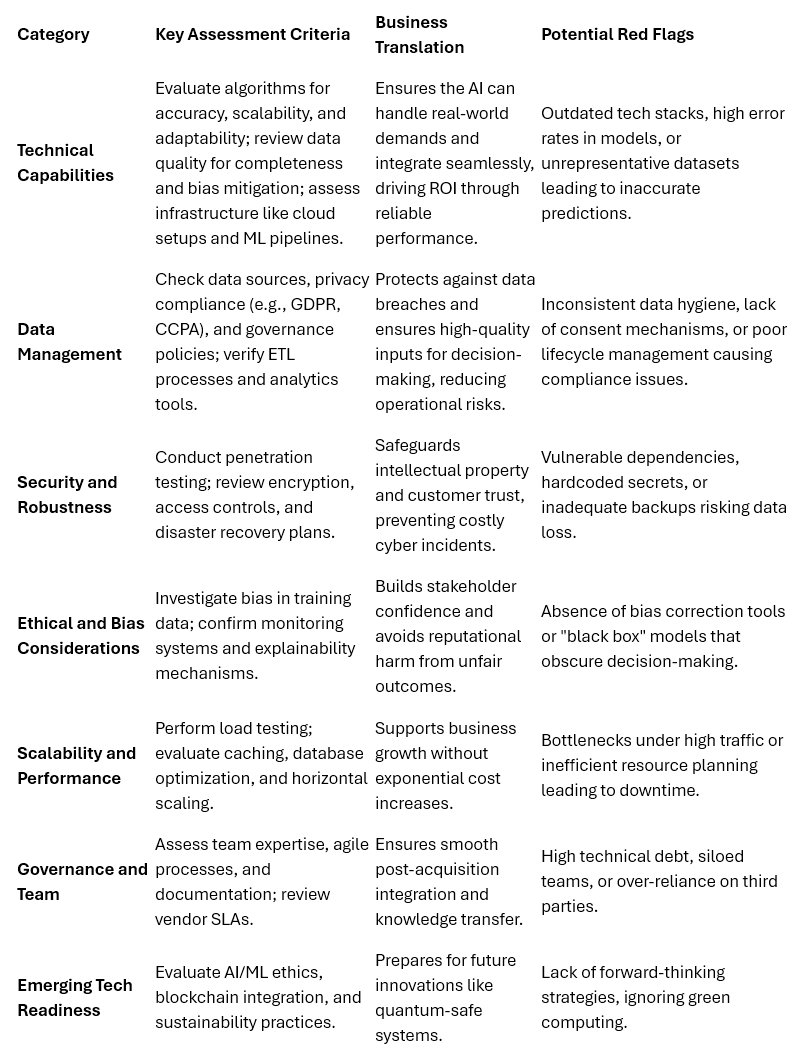

Comprehensive AI Due Diligence Checklist

A robust AI due diligence checklist serves as the foundation for evaluating potential acquisitions or partnerships. Adapted from leading frameworks, this checklist categorizes assessments into technical, legal, ethical, financial, and operational areas. It’s designed for executives to delegate detailed reviews while overseeing key outcomes.

To implement this checklist, executives need to assemble a multidisciplinary team including AI experts, legal advisors, and financial analysts. They need to start with defining objectives, then collect documentation and conduct interviews. Finally, they need to use AI tools for automated reviews to accelerate the process, and incorporate pilot testing to validate claims in controlled settings. Some of the best practices include regular review cycles, thorough documentation, and combining automated with manual testing for nuanced insights.

Valuation Frameworks for AI Capabilities

Valuing AI in M&A demands adapting traditional methods to account for AI’s unique attributes, such as high R&D intensity and variable COGS from model inference. The discounted cash flow (DCF) model remains central, projecting future cash flows discounted to present value, but enhanced with AI-specific adjustments. Unlike SaaS companies with predictable subscriptions, AI firms often feature usage-based pricing, necessitating scenario-based forecasting for risks like model drift or competition.

AI-enhanced frameworks improve accuracy:

ML-Enhanced DCF: Uses neural networks to model non-linear cash flow patterns, incorporating Monte Carlo simulations for probabilistic outcomes.

Comparable Company Analysis: Applies clustering algorithms for peer selection, adjusting multiples for AI factors like IP value.

Predictive Risk Models: Quantifies risks (e.g., 75-85% accuracy in credit risk prediction) using LSTM networks for market forecasts.

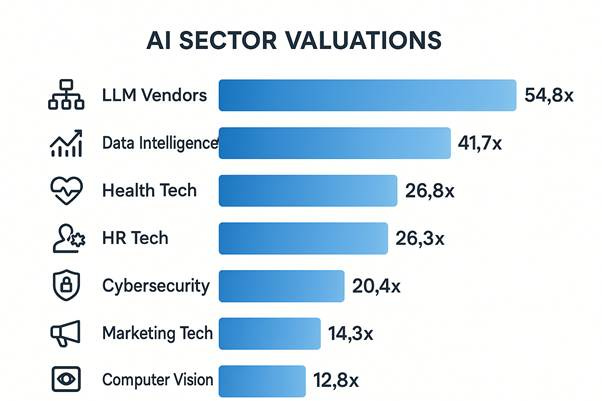

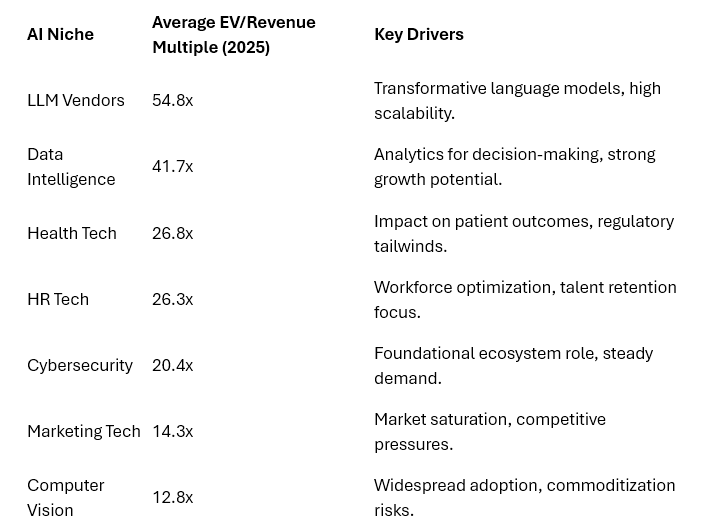

Market multiples provide benchmarks:

For executives, prioritize sustainable economics: Focus on defensible margins and adaptability. High-profile outliers like OpenAI skew perceptions, so ground valuations in fundamentals.

Investors should diversify across niches, while startups emphasize revenue growth for premium multiples.

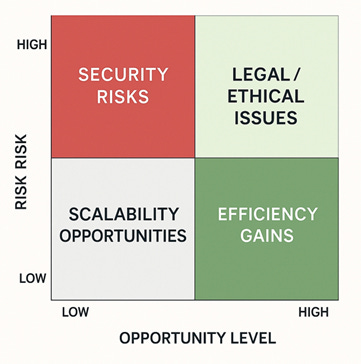

Critical Risks and Opportunities in AI Acquisitions

Mergers and acquisitions involving artificial intelligence include risks. Particularly legal and ethical risks like violating intellectual property rights or biases that incur fines. Security breaches remain the top deal-killer, with privacy law evolving much quicker than you think.

Prospective opportunities in M&A exist by simply leveraging scalable artificial intelligence for efficiency, like multi-agent systems, that require modern data architecture to accomplish. By considering preventative measures, like ongoing assessment and phased rollouts, these same risks can become advantages.

It is important to understand that the bridge between executives and AI is crucial: AI can handle legwork for data-heavy tasks, while executives effectively position it through strategic and ethical oversight. And for 2025, don’t forget to include ESG in your valuations for sustainability risk.

Ultimately, leveraging an effective AI due diligence will allow executives to make informed decisions without sacrificing innovation and common sense. Following this checklist and frameworks will help leaders navigate the incredibility complexities of AI M&A while leveraging long-term value.