The AI ROI Illusion: Why Your AI Investments Are Silently Destroying Shareholder Value

Your CFO is quietly panicking. The board just approved another $50 million for AI initiatives, yet when they ask the one question that truly matters:

“Where is the value?”

You have dashboards tracking model accuracy, glowing reports on pilot projects, and a team of data scientists busier than ever. But tangible, bottom-line impact? That remains frustratingly elusive.

This is the hidden crisis unfolding in boardrooms globally. While the world is caught in an AI investment frenzy, projected to exceed $400 billion in 2025, a dangerous illusion has taken hold. We are mistaking activity for progress and investment for return. The stark reality is that for many, the promise of AI-driven growth is masking a silent destruction of shareholder value.

The AI Investment Paradox

The numbers paint a grim picture. A recent Gartner study revealed that a staggering 73% of AI projects fail to deliver any positive ROI within the first two years. Worse, a 2025 MIT report found that over 95% of generative AI pilots never scale into production in a way that yields meaningful financial savings or incremental profit. We are pouring unprecedented capital into a capability we fundamentally misunderstand how to measure.

This is the AI Investment Paradox: as spending skyrockets, measurable returns are flatlining. The problem lies in our outdated approach to ROI. Traditional metrics, designed for predictable IT projects with clear inputs and outputs, are utterly insufficient for the complex, probabilistic nature of artificial intelligence. We are basically trying to fit a square peg into a round hole, and the result is what I call “AI Theater”, that is a corporate performance where teams look incredibly busy, dashboards are full of impressive-looking metrics, but no real business value is being created. It’s innovation as a spectator sport, and the ticket price is your balance sheet.

Deconstructing the Illusion

Before you can fix the problem, you must diagnose it. Decades of experience in both the technical trenches and the executive suite have shown me that AI projects don’t fail because the technology is flawed; they fail because the strategic and financial frameworks are broken. Here are the five silent killers of AI ROI.

The Vanity Metrics Trap: We celebrate a model’s 98% accuracy in a lab environment, but that metric is meaningless if it doesn’t translate to improved customer retention, reduced operational costs, or increased sales. We have become obsessed with technical performance, forgetting that the only metric that matters to the business is financial impact.

Hidden Implementation Costs: The sticker price of an AI solution is just the tip of the iceberg. The real costs lie beneath the surface: data cleansing and preparation, complex systems integration, and the relentless war for talent. These hidden costs, often running 3-5 times the initial software investment, turn promising ROI calculations into financial black holes.

Opportunity Cost Blindness: Every dollar and every hour your best minds spend on a low-value AI project is a dollar and an hour not spent on a game-changing one. The most significant cost of a failed AI strategy is the market-defining opportunities you miss while your competition pulls ahead.

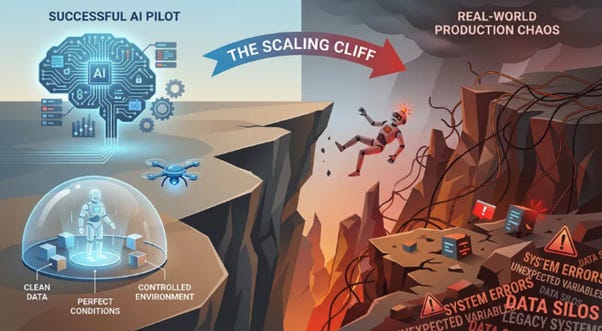

The Scaling Cliff: A successful pilot is a siren’s song, luring you toward the rocks of production. An AI model that works perfectly on a clean, curated dataset will almost certainly fail when exposed to the messy reality of real-world data. An estimated 80% of AI projects never make it past this scaling cliff, dying a quiet death in “pilot purgatory.”

Organizational Drag: You can have the most brilliant AI in the world, but it’s worthless if your organization resists it. The cost of retraining, redesigning workflows, and managing the human element of change is the most underestimated factor in any AI deployment. This “organizational drag” can erode any potential gains before they are ever realized.

A New Playbook for Value

To escape the AI ROI Illusion, we must move from measuring activity to measuring impact. This requires a new mental model for evaluating AI investments, one that embraces uncertainty and focuses on long-term value creation. I call it the ROI Reality Framework.

First, we must redefine what we measure. Instead of focusing solely on lagging financial indicators, we need a balanced scorecard that includes leading indicators of value. This means tracking metrics like decision velocity (how much faster are we making critical decisions?), process simplification (how many steps have we removed from a key workflow?), and capability uplift (what new things can our team do now that they couldn’t do before?).

Second, we must adopt a Value Realization Timeline. Not all AI projects are created equal. Some are quick wins designed for immediate cost savings, while others are strategic bets that may not pay off for years. By categorizing initiatives and setting realistic timelines for value realization, you can manage board expectations and avoid the pressure to show premature returns on long-term, transformative projects.

Finally, we must introduce the concept of “AI Debt.” Like technical debt, AI debt is the long-term cost of short-term decisions. It accumulates when we deploy models without proper governance, use biased data, or fail to document our processes. This debt will inevitably come due, and it will be paid in the form of costly rework, regulatory fines, and reputational damage.

From Illusion to Impact

Navigating this new landscape requires decisive leadership. Here is a four-step playbook to reclaim control of your AI investments and start driving real shareholder value.

1.Conduct a Brutal ROI Audit: Task your finance and strategy teams with a 30-day audit of every AI project in your portfolio. Ignore the vanity metrics. For each project, ask one question: “If this project were a standalone business, would we continue to fund it?”

2.Become a Project Killer: Armed with the audit results, make the tough calls. Any project that cannot demonstrate a clear path to value, or is accumulating significant AI debt, must be killed. This sends a powerful signal that AI Theater is over.

3.Reframe Investment as “Option Value”: For high-risk, high-reward strategic bets, stop trying to force them into a traditional ROI box. Frame them as purchasing “option value”—the right, but not the obligation, to participate in a future market. This aligns the investment strategy with the exploratory nature of cutting-edge AI.

4.Build a Value-First AI Culture: Tie data scientists’ incentives not to model accuracy, but to business impact. Embed finance partners within AI teams. Celebrate failures that yield valuable lessons and create a culture where it is safe to admit that a project is not working.

The Defining Question

The era of blind faith in AI is over. The board is getting smarter, the market is getting tougher, and the pressure to deliver real returns is intensifying. The defining question for your leadership team is no longer “Should we invest in AI?”

It is: “Are we investing in the right AI, in the right way, with the right metrics to create, not destroy, shareholder value?”

Answering that question honestly is the first step out of the illusion and into the reality of AI-driven success.