The AI Executive Brief - Issue #13

Week of December 29, 2025

The $41 Billion Question: Are We Witnessing AI’s iPhone Moment?

SoftBank just placed a $41 billion bet on OpenAI. To put that in perspective, that’s more than the GDP of Estonia, and roughly what Disney paid for Fox. But here’s what should keep you up at night: the fundamental shift from AI that helps to AI that decides.

While competitors chase incremental improvements, a quiet revolution is underway. Open-source models like DeepSeek R1 are matching and sometimes surpassing proprietary systems at a fraction of the cost. Google and OpenAI are locked in a features arms race with Gemini 3 Flash and GPT-5.2. And beneath it all, a infrastructure war is brewing that will determine which companies, industries, and nations lead the next economic era.

The real insight is that 2026 won’t be about who has the best AI but who builds the smartest infrastructure to deploy it at scale.

Strategic Deep Dive

The Agentic Awakening: When AI Stops Asking and Starts Acting

Forget chatbots. This week showcased AI that books your flights, verifies its own work, catches its mistakes, and learns from them without asking permission. Meta’s smart glasses now recognize faces in crowded rooms. Amazon’s Ring identifies delivery drivers before they knock. DeepSeek R1 solves complex reasoning tasks for pennies on the dollar compared to GPT-4.

The democratization of agentic AI is creating a competence paradox. As open-source models close the capability gap, competitive advantage shifts from having AI to deploying it effectively. Companies that mastered AI integration in 2025 will compound their lead; those still in pilot purgatory will find themselves obsolete by Q3 2026.

This raises uncomfortable questions: If your AI agent makes an autonomous purchasing decision that costs millions, who’s accountable? When facial recognition systems embedded in consumer products misidentify someone, what’s your liability exposure? The companies winning this race are redesigning governance frameworks to match machine-speed decision-making.

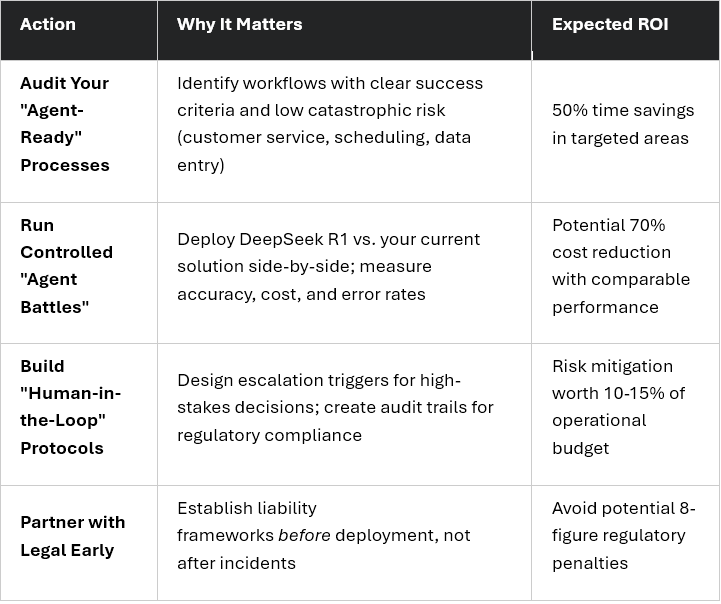

Your 90-Day Playbook

Instead of the traditional framework, consider this pragmatic approach:

While competitors rush to automate everything, the real opportunity lies in selective autonomy. The winners will be companies that identify the 20% of workflows where agents create 80% of value, and then obsess over perfecting those before expanding.

The Infrastructure Gold Rush: Why Data Centers Are the New Oil Fields

Yes, $50+ billion poured into AI infrastructure this week. But focus on the pattern: SoftBank’s OpenAI stake, Meta’s Manus acquisition, xAI’s data center expansion. These are not isolated bets, they are coordinated moves in a high-stakes game where compute capacity is becoming the ultimate moat.

Energy demands are becoming AI’s Achilles’ heel. Data centers now consume power equivalent to small nations, and community opposition is mounting. Alphabet’s $4.75 billion energy deal is just a survival strategy. The dirty secret is that many AI “breakthroughs” are actually hitting a wall limited not by algorithms but by watts per square foot.

U.S. approvals for Samsung and SK Hynix chip shipments to China reveal the real game: everyone wants to control the supply chain while preventing competitors from doing the same. The winners will have secured access to chips, power, and cooling when scarcity hits in late 2026.

Strategic Framework - The Infrastructure Decisiveness Matrix

Instead of maturity levels, think in terms of strategic positioning:

IMMEDIATE (Q1 2026):

Secure Compute Access: Lock in cloud partnerships with SLAs that guarantee GPU availability during peak demand periods

Energy Audit: Calculate your AI operations’ power trajectory; identify renewable energy partnerships now before premium pricing hits

Chip Inventory Strategy: Build 6-month buffer inventory for critical inference chips; diversify suppliers across geographies

NEAR-TERM (Q2-Q3 2026):

Hybrid Architecture: Design systems that shift workloads between cloud and edge based on real-time energy costs and carbon footprints

Efficiency Optimization: Migrate to models like Gemini 3 Flash that deliver 40% power savings; measure ROI in kWh, not just performance

Strategic M&A Monitoring: Track infrastructure acquisitions as leading indicators of capability gaps you may need to fill

TRANSFORMATIVE (2026-2027):

Vertical Integration: Evaluate builds vs. partnerships for proprietary data centers in strategic locations with energy advantages

Agentic Infrastructure: Deploy AI to manage AI infrastructure, autonomous load balancing, predictive cooling, self-optimizing workload distribution

Leadership Action Playbook: The 30-60-90 Day War Plan

WEEK 1-4: Reconnaissance & Quick Wins

Deploy “Shadow Agents”: Run DeepSeek R1 or similar models on 3-5 internal tasks parallel to existing processes. Don’t replace anything yet, gather comparative data on speed, accuracy, and cost. Target: Identify 2 workflows where agents can achieve 40%+ efficiency gains with <5% error rates.

Conduct Infrastructure Stress Test: Model your AI roadmap’s energy and compute requirements through 2027. If projections show >30% annual growth, initiate energy partnership discussions immediately. Alphabet’s move should terrify you. If big tech is locking up renewable energy now, what’s left for everyone else?

Skills Reality Check: Survey your technical teams on agentic AI literacy. If fewer than 30% can explain how self-verifying models work, you have a crisis. Launch emergency upskilling and not generic “AI 101” but hands-on agent deployment training.

WEEK 5-8: Strategic Positioning

Run the “Dependency Audit”: Map every AI vendor relationship and answer: What happens if they 3x prices or face supply constraints? If you lack viable alternatives for critical systems, begin diversification immediately. The open-source surge means you have options, but only if you start testing them now.

Create the “AI Ethics Tiger Team”: Not a compliance checkbox, a cross-functional group with legal, PR, operations, and tech to war-game agent failure scenarios. What if your AI agent discriminates in hiring? Misallocates resources during a crisis? Violates privacy regulations? Document responses before incidents force reactive scrambling.

Partner Aggressively: The India #SkilltheNation model isn’t charity, it’s talent pipeline engineering. Partner with universities and bootcamps to create certified programs in agentic AI. Target: Pipeline of 50+ trained candidates per quarter by mid-2026. Your competitors are doing this; you’re just deciding whether to lead or follow.

WEEK 9-12: Transformation Acceleration

Launch “Agent-First” Initiative: Select one business unit to redesign workflows around agentic assumptions. Not “where can we add AI?” but “if agents handled 70% of decisions, how would we restructure teams, KPIs, and governance?” Pilot for 90 days with full executive sponsorship.

Infrastructure Commitment: Make the build/buy/partner decision on compute infrastructure. Waiting costs you negotiating leverage and potentially 20-30% on energy contracts. If you’re going hybrid, begin procurement for critical on-premise systems.

Board Education Program: Your board likely doesn’t grasp the magnitude of the agentic shift. Create a concise briefing: show them DeepSeek’s cost-performance ratio, explain the energy constraints, and present your 18-month roadmap. Get alignment on investment levels and risk tolerance before budget season.

What Most Briefings Won’t Tell You

The “AI Divide” Isn’t What You Think

Everyone fears AI creating inequality between skilled and unskilled workers. The real divide is emerging between agent-native companies and everyone else. Firms that rebuild around agentic assumptions will operate at 2-3x the efficiency of those trying to “add AI” to legacy processes. By Q4 2026, this performance gap will be visible in market valuations.

The Open-Source Wildcard

DeepSeek’s emergence is the canary in the coal mine. If open-source models continue matching proprietary performance at 5-10% of the cost, the entire AI business model collapses. OpenAI’s $41 billion valuation assumes sustained competitive moats. But what if those moats evaporate in 18 months? This doesn’t mean “don’t invest in AI”, it means invest in integration capabilities, not just model access.

The Energy Reckoning:

We’re 12-18 months from infrastructure constraints becoming the primary AI bottleneck. When cloud providers start rationing GPU access or implementing surge pricing during peak demand, who’s positioned to weather it? The unsexy answer is that companies that invested in energy partnerships and efficiency optimization in early 2026.

The Leadership Moment

This week’s developments mark the end of AI’s experimental phase. The technology has evolved from curiosity to capability to critical infrastructure in less than 36 months. This pace makes previous industrial revolutions look leisurely.

But here’s the paradox that should focus every executive decision: The same agentic systems that promise 50% efficiency gains also concentrate risk in ways we haven’t fully mapped. When AI moves from advisor to autonomous actor, leadership shifts from “adopting technology” to “governing machine decision-making at scale.”

The question for 2026 is: Are you building AI to augment human judgment or replace it? The companies that answer “augment” with conviction, investing equally in technology and the humans who direct it, will capture the upside while avoiding the catastrophic downsides that will define cautionary tales by 2027.

Your competitive advantage won’t come from having the smartest AI but from being the smartest about deploying it.

The $41 billion bet is about SoftBank’s belief that whoever controls the infrastructure layer for agentic AI will control the next decade of value creation. The is whether you’re making comparable bets in your strategic positioning.

2026 will separate the executives who saw AI as a tool from those who recognized it as the operating system for modern business. Which will you be?